When the lights fade, the final whistle blows, and the fans go home—what’s next? For too many athletes, the answer is financial uncertainty. But it doesn’t have to be. You worked too hard to let your money run out.

This isn’t another preachy piece telling you to eat Cup Noodles and save everything you can. This is about using the wealth you earn during your athletic prime as seed money to build something even greater. Your legacy. Your second act.

Why This Matters Now

The average NFL career lasts just 3.3 years. The NBA? About 4 years. Even if you’re earning millions, the cold, hard truth is that those income streams can dry-up fast. According to Sports Illustrated, nearly 78% of NFL players face financial stress within just two years of retiring.

Let’s be real: the system isn’t built to teach you about cash flow, tax shelters, private equity, or how to hire the right financial advisor. To be successful in your career you must be focused on your training and your performance. But that doesn’t mean you shouldn’t learn.

You don’t have to live like a monk to build wealth—but you do need to have a plan.

Entrepreneurship: A Wealth-Building Strategy for Modern Athletes

1. Think “Seed Capital,” Not Retirement Fund

This isn’t about saving for a beach house at 60, or worse, living like a monk while you’re being successful. It’s about planting the seeds now that can grow into a business, a foundation or a brand. Your career earnings should be your launchpad.

2. You Don’t Have to Live Like a Monk to Invest. Live on the Salary, Invest the Rest on the Future.

Endorsements, performance bonuses, and licensing deals? That’s your growth fund. Your base salary should cover your lifestyle, and the rest should be invested.

3. Invest in What Excites You, and Consider Entrepreneurship

Real estate is fine. Stocks are solid. They’ll very likely play a role in your financial journey. But what really moves you? What business would you actually want to wake up and build up when your time on the field ends?

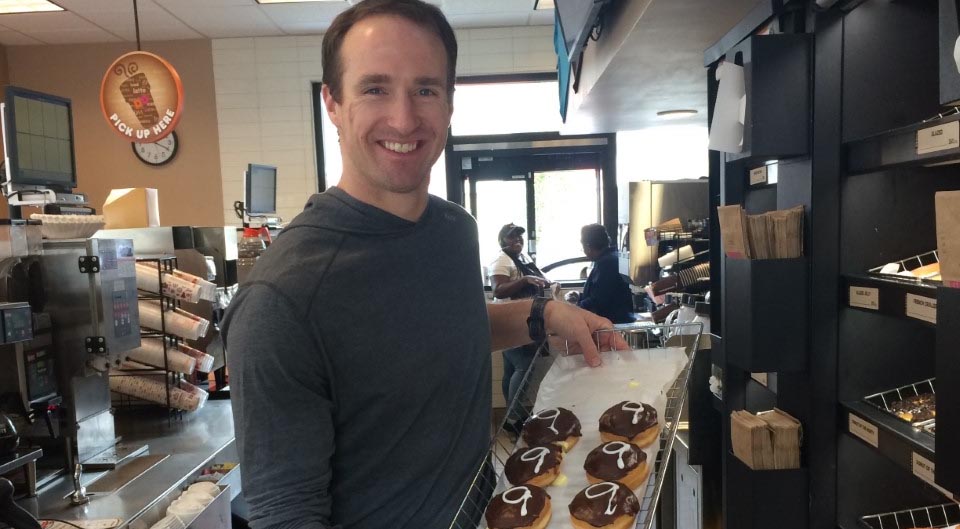

You don’t necessarily have to be LeBron James or Roger Federer to build substantial, money-making businesses. Athletes like basketball’s Dwayne Dedmon (Wingstop franchises and real estate), Falcons QB Kirk Cousins (Chick-fil-A franchises), soccer’s Juan Mata (Common Goal), and MMA legend Demetrious Johnson (Quantum Energy Square) have used their platforms to build successful entrepreneurial careers even before retirement.

Entrepreneurship has many shapes and forms nowadays. Newly-minted MBAs without the brand or name recognition of athletes are buying up small-and-medium businesses with potential and growing them organically and through acquisitions.

Entrepreneurship-Through-Acquisition (ETA) is a popular entrepreneurial path we are finding ourselves recommending to our clients more frequently these days. It benefits from financing support from the federal government at very favorable terms, generous tax incentives and helps acquirers avoid the pain of starting businesses from scratch.

Even if managing a business doesn’t really attract you, investing in ETA Funds and similar middle-market Private Equity funds offer a potential path to outsize investment returns.

4. Use Your Personal Brand to Grow Your Business

You’re more than an athlete. Social media isn’t just for clout—it can be equity building. Use your story to attract customers and potential partnerships.

Specialized Financial Advisors Can Help You Get Started. But Get The Right Team.

Working with specialized financial advisors that deeply understand the very unique finances athletes have and can dedicate significant time and attention to your investments. Massive financial firms are typically not a good fit for athletes, as they tend to offer more generalized advice and strategies that don’t really apply to athletes’ unique careers and needs.

You earned your wealth young and by investing it you can make it last through retirement and hopefully beyond. You can and should enjoy the lifestyle, the cars, the travel. But let by investing your money you can build. That doesn’t mean retreating from life—it means investing in your next one.

Athletic careers end. The rest of your life starts.

Handal Dunaway: Specialized in Helping Athletes and Coaches Invest

At Handal Dunaway, we know that athletic careers are intense—but often short-lived. That’s why our team is dedicated to helping you turn today’s earnings into tomorrow’s empire. We offer tailored strategies in investing, business development, and long-term wealth planning—built specifically for athletes like you. Whether you’re just starting out or planning for your next chapter, we’re here to make sure your success off the field matches what you’ve achieved on it.

investment investment investment investment investment investment investment investment investment investment investment investment investment investment investment